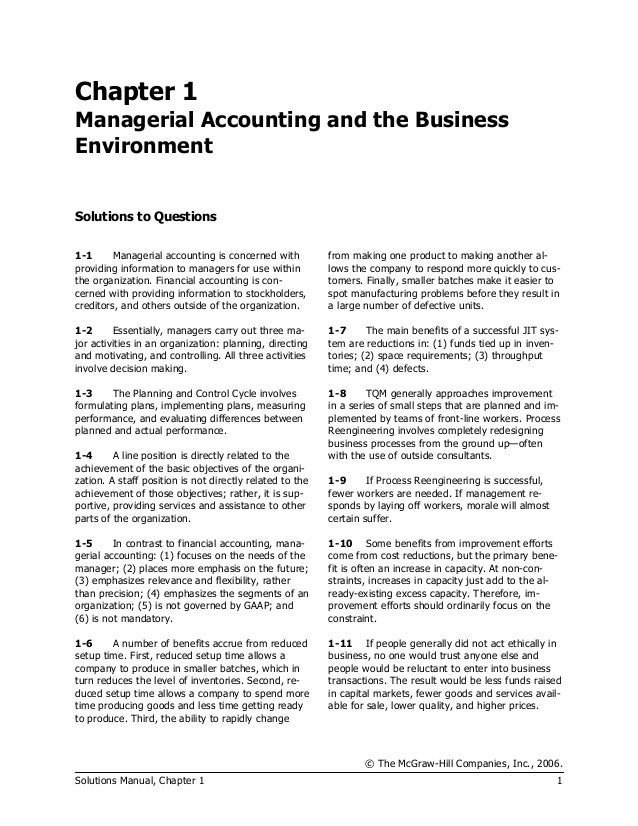

Solutions Managerial Accounting Garrison 14th Edition

Aug 26, 2013 test bank solution manual, testbank, test bank, solution manual, publisher, book, university, college, instructor, accounting, management, organization.

Variable and Absorption Costing Unit Product Costs Shastri Bicycle of Bombay. Windows Password Crack Free. Produces an inexpensive yet rugged, bicycle for use on the city’s crowded streets that it sells for500mpees.

(Indian currency is denominated in rupees, denoted by R.) Selected data for the company's operations last year follow: Units in beginning inventory 0 Units produced 10,000 Units sold 8,000 Units in ending inventory 2,000 Variable costs per unit Direct materials R120 Direct labor R140 Variable manufacturing overhead R50 Variable selling and administrative R20 Fixed costs: Fixed manufacturing overhead R600,000 Fixed selling and administrative R400,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one bicycle. Assume that the company uses variable costing. Compute the unit product cost for one bicycle.

Classifying Manufacturing Costs Your Boat, Inc. Assembles custom sailboats from components supplied by various manufacturers. Windows Xp Professional Service Pack 3 32 Bit Free Download on this page. The company is very small and its assembly shop and retail sales store are housed in a Gig Harbor. Washington, boathouse. Below are listed some of the costs that are incurred at the company.

Req uired: For each cost, indicate whether it would most likely be classified as direct labor. Direct materials. Manufacturing overhead. Or an administrative cost. The wages of employees who build the sailboats. The cost of advertising in the local newspapers.

The cost of an aluminum mast installed in a sailboat. The wages of the assembly shop's supervisor. Rent on the boathouse.

The wages of the company's bookkeeper. Sales commissions paid to the company's salespeople. Depreciation on power tools.